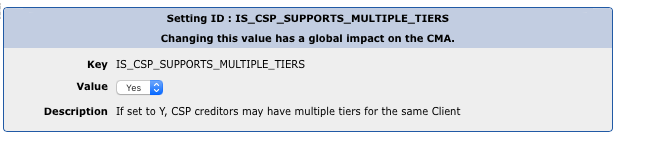

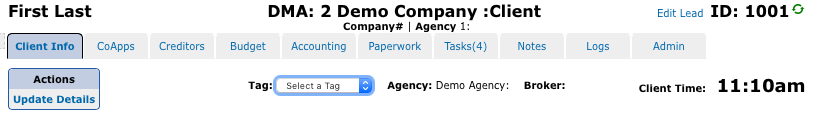

In order to support the Counselor Emergency Response Program (CERP), a new Hardship Indicator has been added to the CMA.

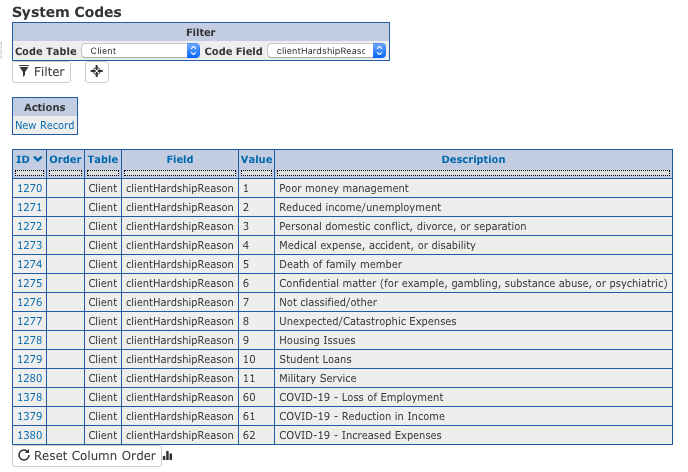

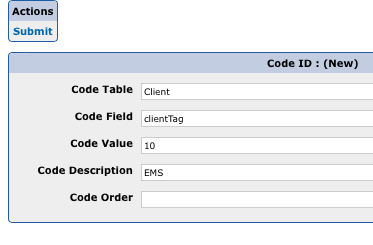

The three Virus Related Hardships (VRH) were already added as part of EMS support and are available under the Lead/Budget tab.

Steps required by the Agency

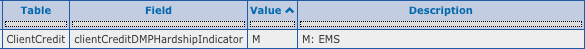

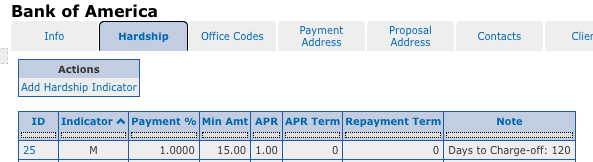

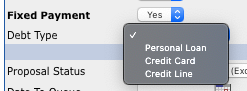

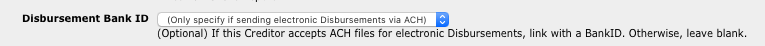

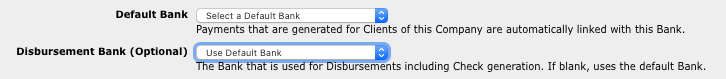

- The hardship indicator should be added to participating Creditors using the DMA/Creditors view under the Hardship tab.

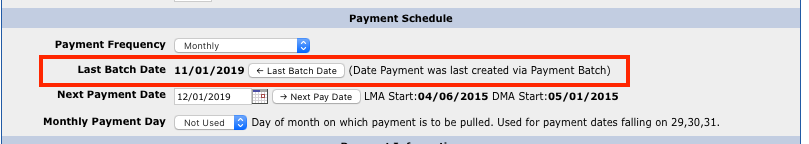

Because this hardship is a deferral, all terms should be left at 0.

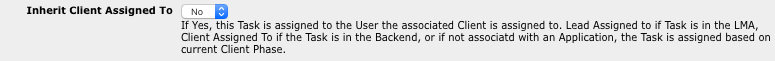

- Add a new CERP Task with a due date of 45 days so that you can review the Client account prior to 60 days. Expire time should be set to 3888000 seconds.

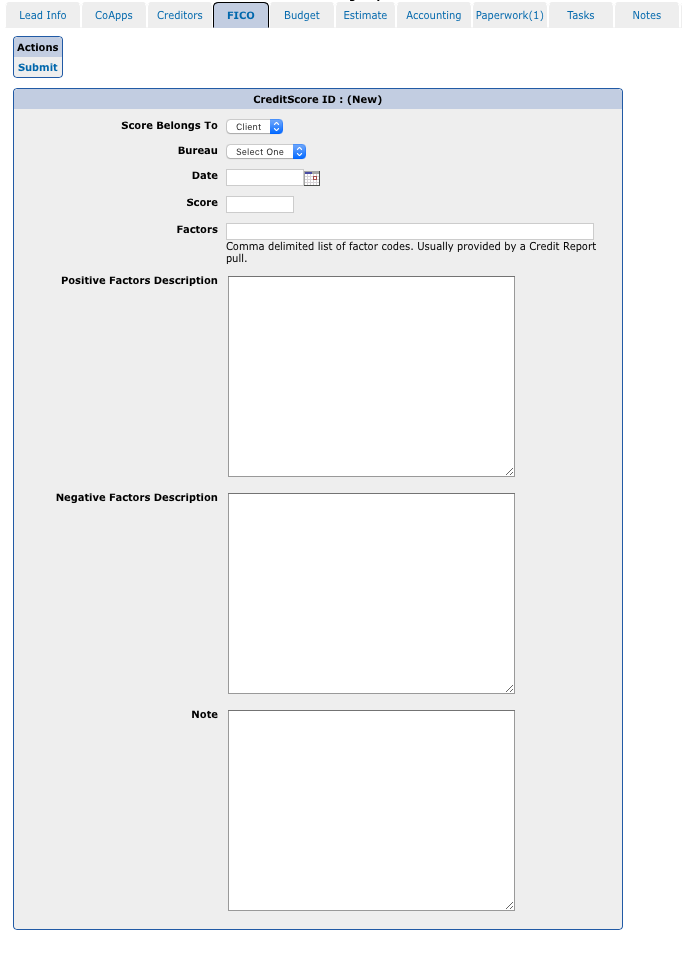

To enroll a ClientCredit account in CERP:

This applies to 1b and 2b.

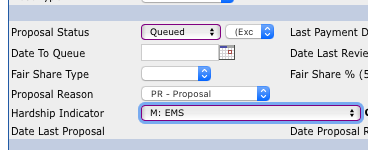

- change the Proposal Status to Queued

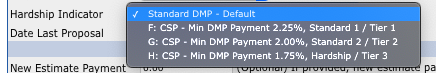

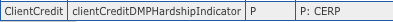

- change the Hardship Indicator to P: CERP

- remove the DMP BillerID to prevent the account from appearing in the RPPS DMP report

- create a CERP Task for the client to follow up prior to 60 days

Generating the Peregrin CSV file

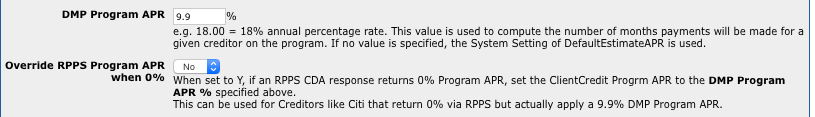

Currently, the Peregrin CSV file should be populated manually as it may contain a mix of EMS and CERP proposals along with a reason code of 1a, 1b, 2a, or 2b, depending on whether this is an already enrolled Client.

As the file is populated, the ClientCredit Proposal status should be changed from Queued to Pending indicating that a response is pending from the Creditor.

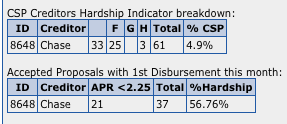

To make it easier to identify which ClientCredit accounts are enrolled in a CERP product, the DMA/Client Creditors report has been modified as follows:

– added a Hardship Reason filter

– the Hardship Indicator filter now supports multi-select